Options & Volatility Research

Advanced Derivatives

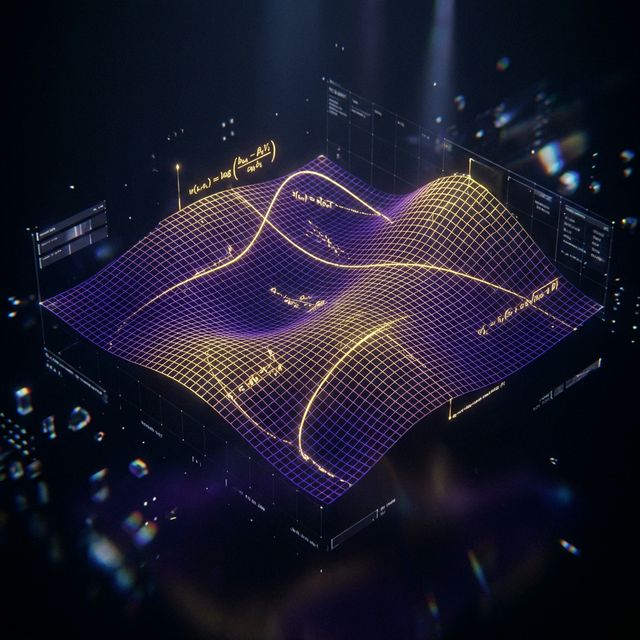

Our multi-leg derivatives desk models complex volatility surfaces using local volatility and SABR frameworks. We identify structural mispricings between implied and realized volatility by employing deep neural networks to forecast gamma curves and earnings-event crush dynamics. Strategies are meticulously delta- and vega-hedged, targeting pure premium decay and dispersion arbitrage opportunities.

Key Competencies:

- Deep learning models for vol surface interpolation and implied-vs-realized forecasting.

- Automated dispersion trading across index constituents vs index aggregates.

- Real-time Greeks management (Delta, Gamma, Vega, Vanna, Volga) for strict risk isolation.